Closing the Gaps: What New Broadband and Housing Permit Data Tell Us About Community Growth

Before joining mySidewalk, I spent years planning transportation networks and city development—systems built to move people, ideas, and economies. Whether we’re talking about roads, broadband, or housing, one thing holds true: when systems don’t reach everyone, opportunity doesn’t either.

This belief is why I get excited about the data we make accessible: because we’re not just showing what currently exists, we’re revealing what’s possible. And two of our newest datasets—the FCC Broadband availability data and the US Census Building Permit Survey (BPS)—are helping community leaders do just that.

These datasets are useful on their own, but they shine brightest when used together. Especially when layered with other community data, like income, education, commute times, and even customer-uploaded datasets like area plans, zoning areas, or grant regions.

Chambers of commerce, economic development teams, and housing agencies alike can look to these datasets for more than numbers. They’ll be able to tell their community’s growth story with depth, evidence, and heart. And as funding streams continue to be uncertain, being able to do so at scale, in a replicable way, makes reporting faster and easier than ever.

Insight into Infrastructure and Growth

Communities building for growth don’t just need more, they need better. Better infrastructure, better connectivity, better insight. These two datasets help uncover not only where digital and physical development are happening, but whether they are building on momentum, or expanding access to new markets.

Insights Beyond Speed

In addition to where broadband internet exists, dataset shows you where it doesn’t. It goes beyond the usual “maximum advertised speed” and includes:

- Median download/upload speeds

- Households below the FCC’s broadband standard (25 Mbps down)

- This threshold is the FCC’s minimum standard for telecommuting and student activities.

- Breakdowns by technology (fiber, DSL, satellite, etc.)

This allows you to see not just availability, but quality and equity of access. All critical for workforce development, digital inclusion, and site readiness.

Residential Requests

The BPS dataset is updated monthly, making it your real-time lens into residential development. It includes:

- New residential units authorized, by structure type

- Monthly, year-to-date, and annual trends

- Permit valuations and building size

Whereas most housing data shows where we’ve been, this shows what’s coming next. It might not be or look exactly like a crystal ball, but having access to a leading indicator of growth and community investment like this can help you prepare for what’s to come.

Telling Stories of Readiness

Chambers and economic developers are the narrators of local momentum. You need data that helps you showcase opportunity and remove friction for investment.

When I envision our customers getting the most out of these data, I see them leveraging it to:

Prove infrastructure capacity

Highlight areas with strong broadband and housing growth to attract employers or developers.

Identify areas of growth opportunity

Find neighborhoods with growth potential but lagging digital access to target for public investment.

Track live development signals

Use monthly BPS data to show market responsiveness and guide site selection conversations.

Layer in workforce, education, and income data

Tell a comprehensive story about who lives here, what they need, and where they’re headed.

Planning with Precision

Housing leaders are working to address immediate needs while planning for long-term stability. That requires understanding both supply and access. But better yet, understanding which factors might influence fluctuations in residential housing builds can make plans for investments more well-rounded and

Measure market responsiveness

See if the pace of permitting aligns with your local, regional, or statewide housing goals.

Assess where housing is being built vs. where it’s needed

Overlay BPS data with affordability, commute time, or demographic indicators.

Ensure digital infrastructure supports new development

Use FCC data to evaluate broadband readiness in growing areas.

Make compelling cases for funding or zoning adjustments

Show the intersection of unmet demand, digital inequity, and neighborhood change.

A Data-Driven Mode of Growth

In my transportation planning days, we spent a lot of time thinking about connections: how people move, where they get stuck, what’s missing. And that’s what I think about now when I look at datasets like these.

Permits and broadband speeds might sound technical, but they tell deeply human stories. They tell us who has a foundation to build on—and who’s still waiting. They show us where momentum is building, and where it’s stalling out. They give us the evidence to fight for smarter investment, more equitable development, and meaningful access to the economy.

But most importantly, they help us see what’s possible, not just what’s measurable. They let you connect growth to impact. To say: “Yes, we’re building more homes. Yes, they’re going where they’re needed. And yes, those homes are in communities where people can connect to jobs, education, and each other.”

When you combine public data, local knowledge, and the right tools, you’re not just analyzing your community, you’re designing the kind of future possible for those who call it home.

— Drew

Share this

You May Also Like

These Related Stories

Why The New HUD Rule Change Is a Mission Critical Problem

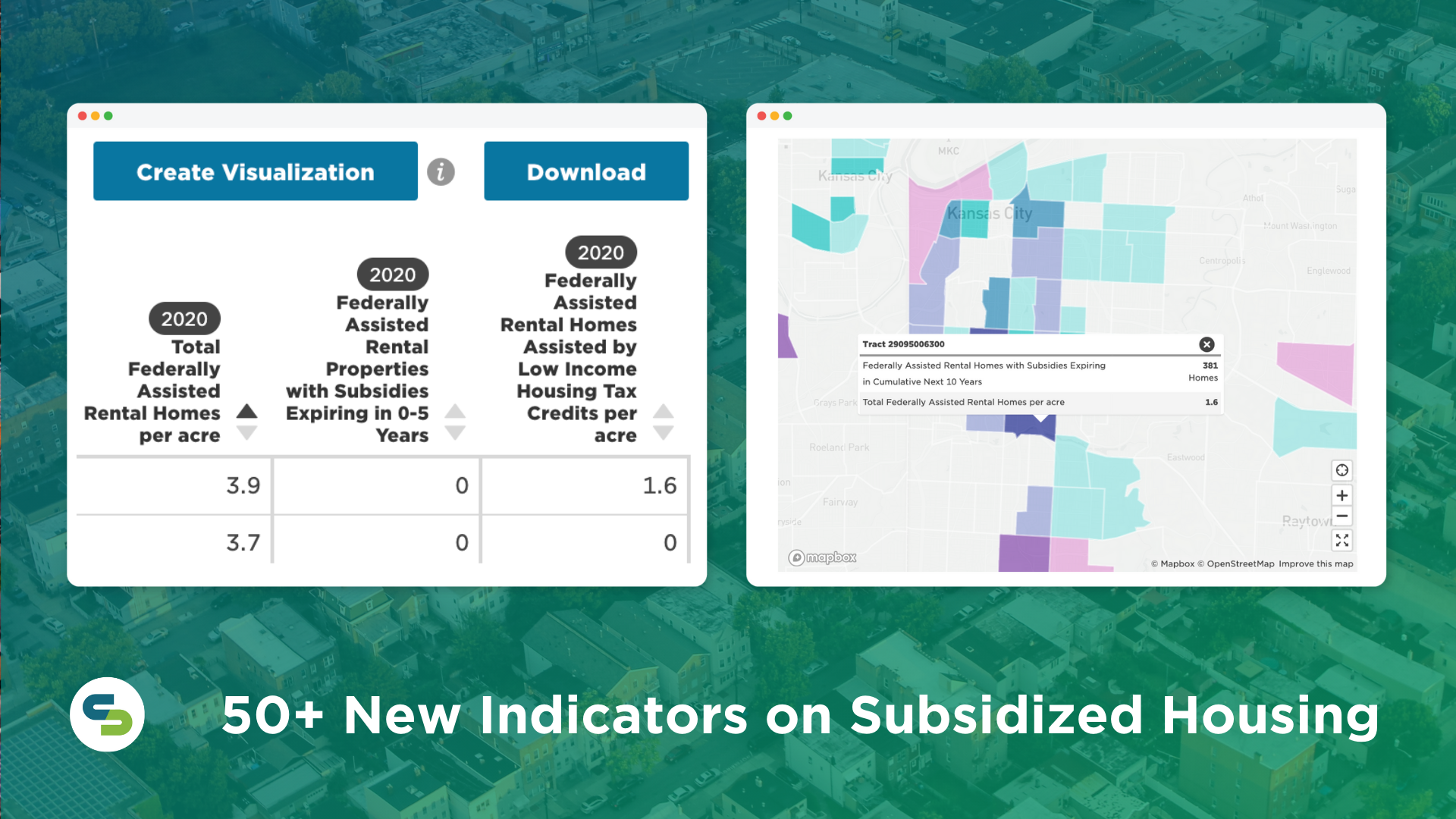

Locate Your Community's Affordable Housing with Data from the NHPD

.png)

No Comments Yet

Let us know what you think